These instructions relate to businesses that do not have STP and JobKeeper enabled payroll systems.

Below are some instructions from the ATO website reformatted slightly to make it easier to navigate about how to identify your employees depending on your payroll systems and number of employees. ATO deadlines for Identification of employees have been extended for enrolment and Identification of employees for April and May JobKeeper fortnights to 31 May 2020.

Payment from the ATO under the JobKeeper program will not be processed until you:

- Identify employees/business participants; and

- report your GST turnover for April (actual) and May (projected)

Please note that the wage condition requirement ($1,500 paid per month per eligible employee) must be met by 8th May for the April JobKeeper fortnights.

For the May JobKeeper fortnights:

- For the first May Fortnight (27/4 to10/5) paid by 10th May

- For the second May fortnight (11/5 to 24/5) paid by 24th May

Use the table immediately below to navigate to the appropriate section of the article for instructions on how to identify a business participant and/or employees for the 2nd step in the JobKeeper program:

- Sole Traders with no employees

- Sole Trader with employees

- If you use STP enabled payroll software that does not offer JobKeeper functionality and you have 200 employees or less

- If you don’t have STP enabled payroll software and you have 40 employees or less

- If you don’t have STP enabled payroll software and you have more than 40 employees

- If you use STP enabled payroll software that does not offer JobKeeper functionality and you have more than 200 employees

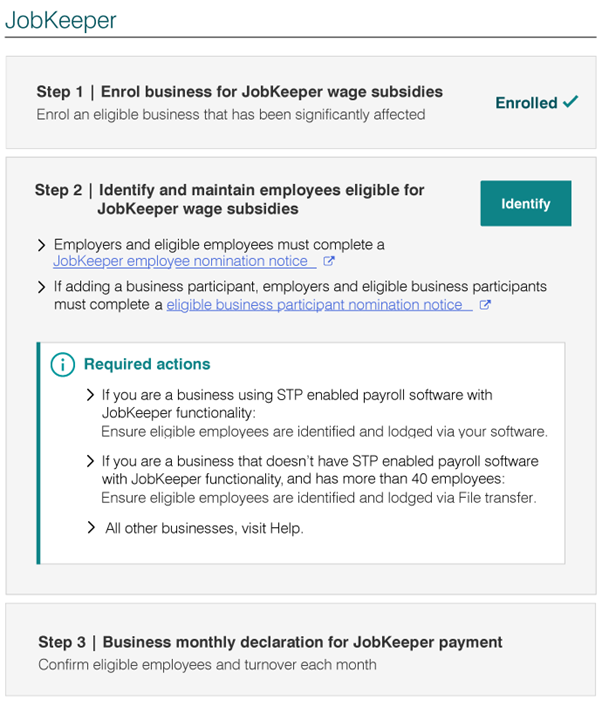

Step 2: Identify and maintain your eligible employees

You, or your registered tax or BAS agent, must identify each person that you will claim the JobKeeper payment for.

You only identify eligible employees once. Ensure you include:

- yourself as a sole trader, if eligible

- all employees who are eligible or have the potential to be eligible for JobKeeper in coming months.

Before you start

- Make sure you have completed Step 1: Enrol for the JobKeeper payment, including nominating yourself as an eligible business participant.

- Make sure you meet the eligibility requirements.

- If you have employees, make sure you have

- the name, tax file number (TFN) and date of birth details for all employees. If you use STP enabled payroll software, this information will be prefilled for you, but you will still need this information for any extra employees you want to include

- a completed JobKeeper employee nomination notice for each eligible employee.

- Know your GST turnover for this month and projected for next month.

- Talk to your registered tax or BAS agent and nominate them to act on behalf of your business if you want them to do this step for you.

Important: You cannot save the form while you are working on it and you cannot edit it once it is submitted. Read the instructions carefully to make sure you have all the information you need before you begin.

How to identify and maintain your information

Sole traders with no employees

If you are a sole trader with no employees, log into ATO online services through myGov, or log into the Business Portal using myGovID.

View the COVID-19 screen and select Step 2 Identify and maintain employees eligible for JobKeeper wage subsidies.

Fill in the JobKeeper enrolment form by confirming the required fields.

Required fields

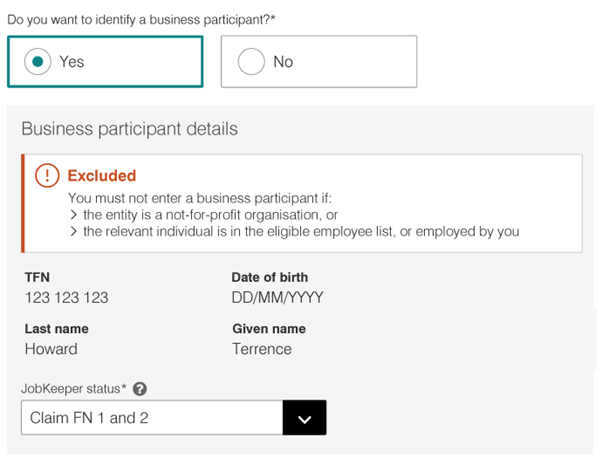

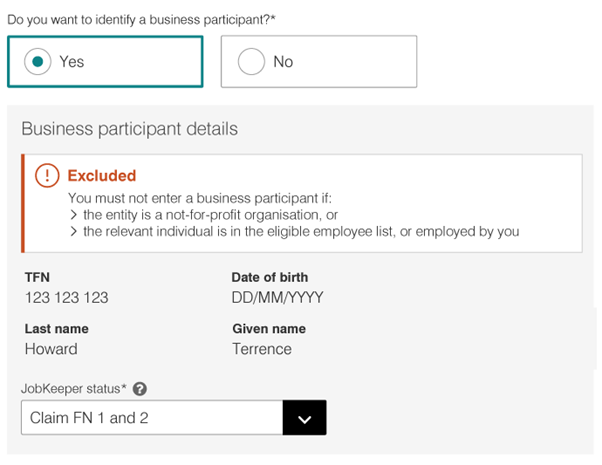

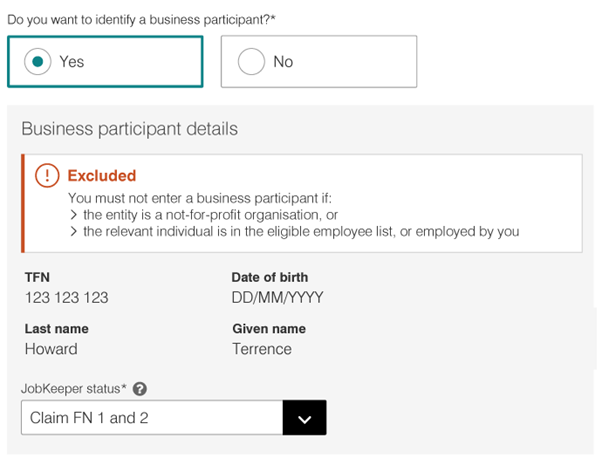

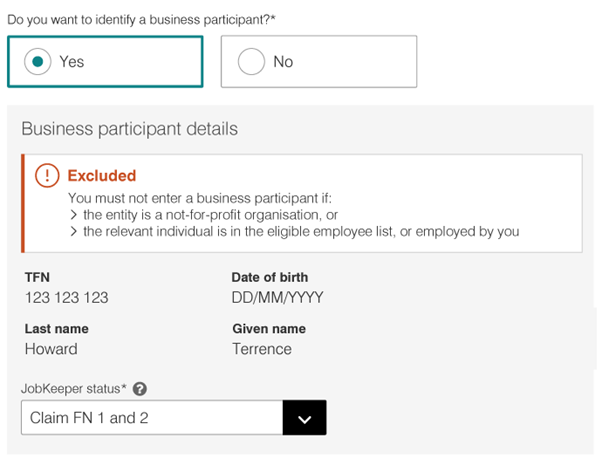

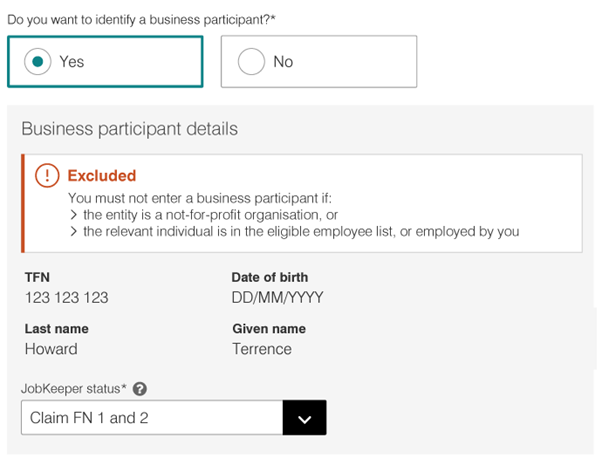

Confirm that you are nominating yourself as the eligible business participant.

Select your eligible JobKeeper status. JobKeeper status identifies the JobKeeper fortnights (FN) that you’re claiming.

To select an eligible JobKeeper status:

- Not claiming yet – you are not currently eligible or not yet claiming for this month’s JobKeeper fortnights.

- Claim FN 1 and 2 – you are claiming both JobKeeper fortnights in this month.

- Claim only FN 1 – you are claiming fortnight one only. You are not eligible to claim fortnight two.

- Claim from FN 2 – you are claiming fortnight two only. You are not eligible to claim fortnight one.

If you do not want to claim the JobKeeper payment for yourself, or you are not currently eligible as a business participant, select ‘Not claiming yet’ from the drop down menu.

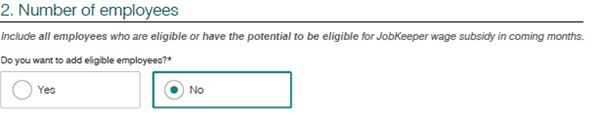

Confirm if you want to add eligible employees: Select No if you don’t have any employees to identify.

Tips:

- If you are completing this step for April, you will move automatically to Step 3: Make a business monthly declaration

- If you are completing this step for May, check the summary section is correct before you submit.

- Use the Print friendly function to capture your successful JobKeeper enrolment details in PDF format. You may want to save this information, including your JobKeeper receipt number, for your records.

Next step:

Step 3: Make a business monthly declaration

Sole traders with employees

You can identify your eligible employees in one of the following ways:

- Directly into your payroll software, providing your STP enabled payroll software has been updated with JobKeeper functionality

- Using ATO online services by myGov or the Business Portal.

Enter employees directly into your payroll software

If you use STP enabled payroll software updated with JobKeeper functionality, first update each eligible employee in your payroll software and lodge using your payroll software. You can use the ‘STP pay event’ to notify us of your eligible employees.

Payments made to eligible employees must be included in the STP pay event.

Use this guide or speak to your software provider if you need more help.

Then log into ATO online services through myGov, or the Business Portal using myGovID.

View the COVID-19 screen and select Step 2 Identify and maintain employees eligible for JobKeeper wage subsidies

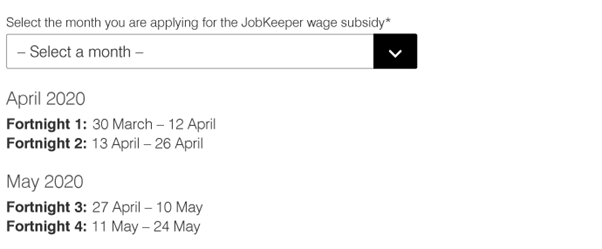

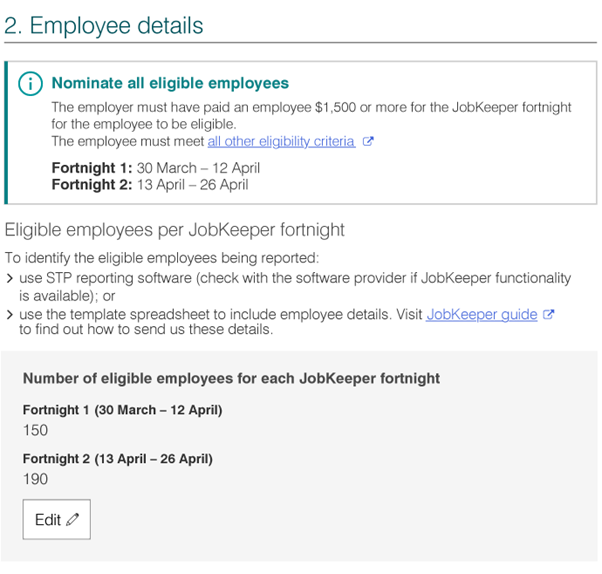

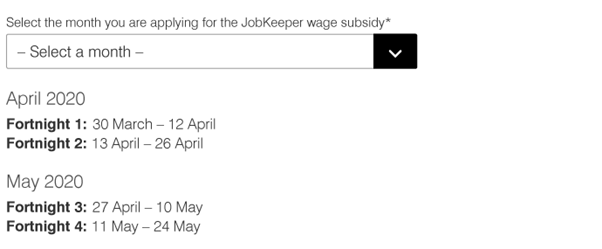

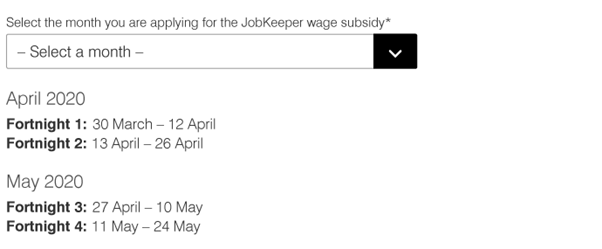

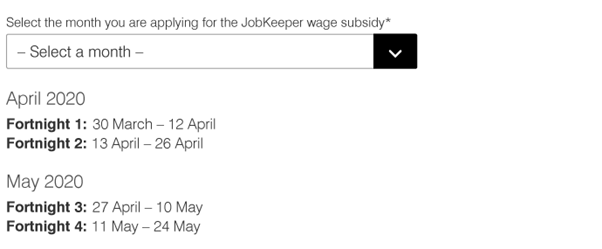

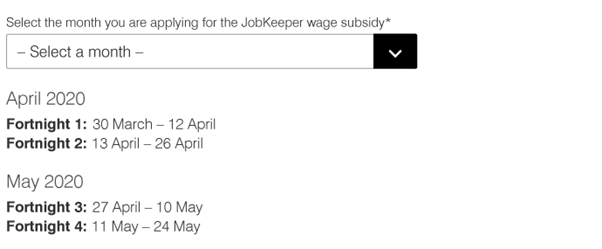

Select the month you are identifying eligible employees to claim for. You could be identifying eligible employees for payments made in April or May 2020.

Confirm that you are nominating yourself as the eligible business participant. Select your eligible JobKeeper status. JobKeeper status identifies the JobKeeper fortnights (FN) that you’re claiming.

There are four JobKeeper status options to choose from:

- Not claiming yet – you are not currently eligible or not claiming for this month’s JobKeeper fortnight.

- Claim FN 1 and 2 – you are claiming both JobKeeper fortnights in this month.

- Claim only FN 1 – you are claiming fortnight one only. You are not eligible to claim fortnight two.

- Claim from FN 2 – you are claiming fortnight two only. You are not eligible to claim fortnight one.

If you do not want to claim the JobKeeper payment for yourself, or you are not currently eligible as a business participant, select ‘Not claiming yet’ from the drop down menu.

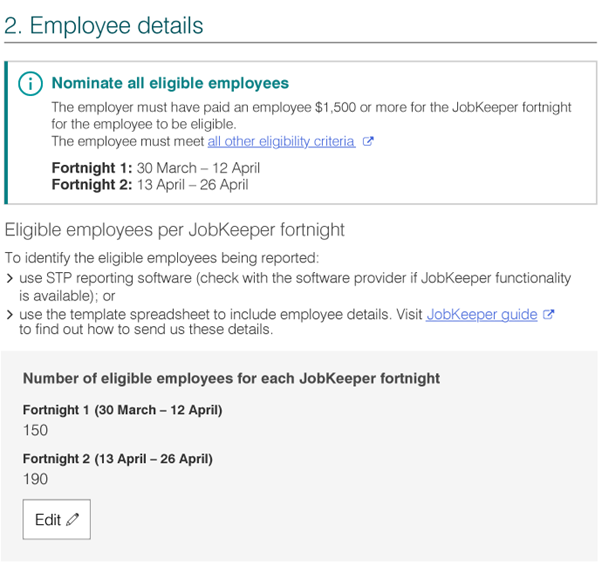

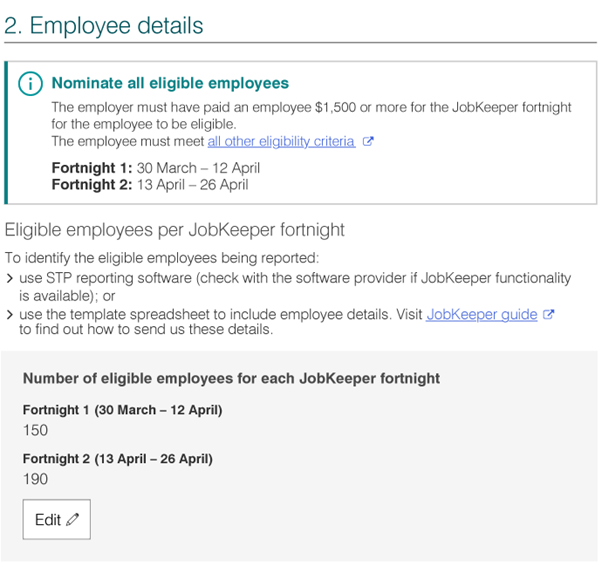

Confirm your number of eligible employees:

- The number of eligible employees is prefilled based on your lodged STP pay report.

- Check the number is correct or edit the number to reflect the correct number of eligible employees for each JobKeeper fortnight.

Tips:

- If you are completing this step for April, you will move automatically to Step 3: Make a business monthly declaration

- If you are completing this step for May, check the summary section is correct before you submit.

- Use the Print friendly function to capture your successful JobKeeper enrolment details in PDF format. You may want to save this information, including your JobKeeper receipt number for your records.

Changing employees information

You make changes to eligible employees details in your software.

Enter employees using ATO online services on myGov or the Business Portal

How you enter employees depends on your payroll software and number of employees:

- If you use STP enabled payroll software that does not offer JobKeeper functionality and you have 200 employees or less

- If you don’t have STP enabled payroll software and you have 40 employees or less

- If you don’t have STP enabled payroll software and you have more than 40 employees

- If you use STP enabled payroll software that does not offer JobKeeper functionality and you have more than 200 employees

If you use STP enabled payroll software that does not offer JobKeeper functionality and you have 200 employees or less

If you use STP enabled payroll software that does not offer JobKeeper functionality and you have 200 employees or less, you need to:

Log into ATO online services through myGov, or the Business Portal using myGovID.

View the COVID-19 screen and select Step 2 Identify and maintain employees eligible for JobKeeper wage subsidies.

Select the month you are identifying eligible employees to claim for. You could be identifying eligible employees for payments made in April or May 2020.

Confirm that you are nominating yourself as the eligible business participant. Select your eligible JobKeeper status. JobKeeper status identifies the JobKeeper fortnights (FN) that you’re claiming. Your details will be prefilled from when you enrolled.

Select an eligible JobKeeper status:

- Not claiming yet – you are not currently eligible or not claiming for this month’s JobKeeper fortnights.

- Claim FN 1 and 2 – you are claiming both JobKeeper fortnights in this month.

- Claim only FN 1 – you are claiming fortnight one only. You are not eligible to claim fortnight two.

- Claim from FN 2 – you are claiming fortnight two only. You are not eligible to claim fortnight one.

If you do not want to claim the JobKeeper payment for yourself, or you are not currently eligible as a business participant, select Not claiming yet from the drop down menu.

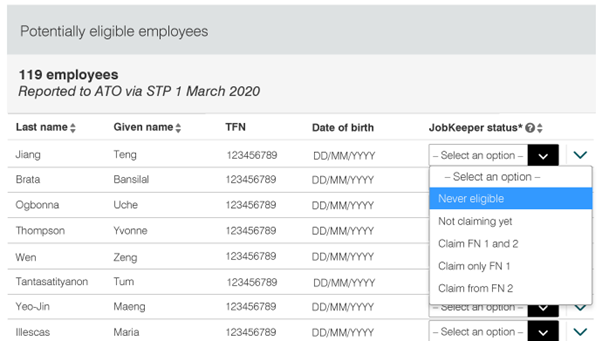

Identify your eligible employees

Confirm your employee details:

- Select eligible employees from a list of employees prefilled from your STP pay report.

- Select a JobKeeper status for each of your eligible employees to identify the JobKeeper fortnights you’re claiming for them

- Never eligible – the employee is not eligible and you will never be able to claim for them. After you lodge, these employees will be removed as potentially eligible employees.

- Not claiming yet – you are not claiming for the employee now, but may claim later, for example, they are on maternity leave and will be returning to work in June.

- Claim FN 1 and 2 – you have paid the minimum $1,500 to this employee in both fortnights and are claiming those fortnights.

- Claim only FN 1 – you have paid the minimum $1,500 to this employee in the first fortnight only and are claiming fortnight one.

- Claim from FN 2 – you have paid the minimum $1,500 to this employee in the second fortnight only and are claiming fortnight two.

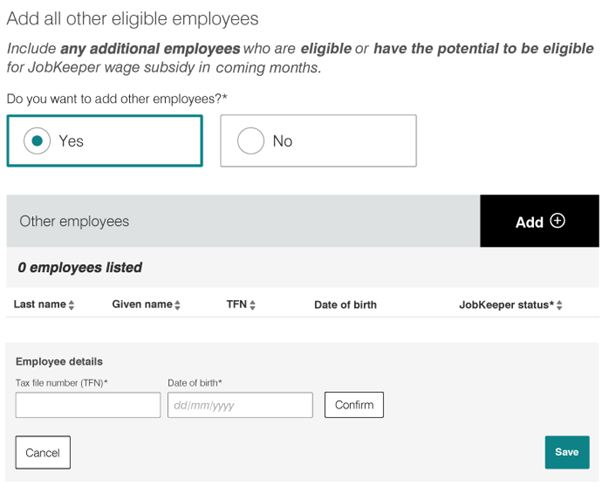

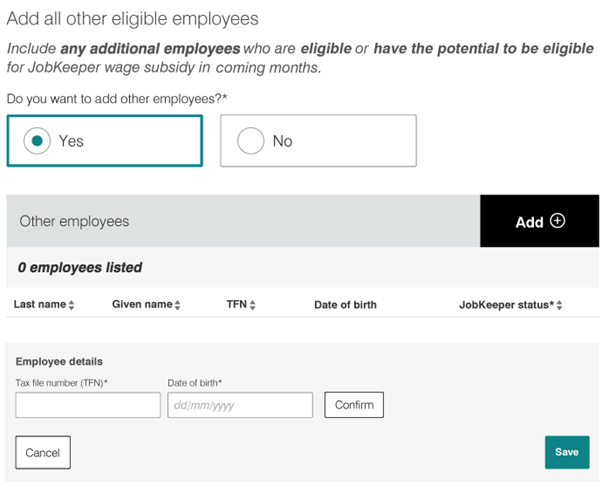

If you have additional eligible employees who are not in your prefilled list:

- Select Yes if you want to add any additional employees who are eligible or have the potential to be eligible later.

- Add up to 40 additional employees using their tax file number (TFN) and date of birth.

- Select Confirm then Save to add your eligible employee to the list.

- Select a JobKeeper status for each of your additional eligible employees to identify the JobKeeper fortnights you’re claiming for them.

This list of identified eligible employees will appear as a prefilled list in future months and you will be able to make changes to it. You will not be able to add additional eligible employees online once you complete step 2.

Tips:

- If you are completing this step for April, you will move automatically to Step 3: Make a business monthly declaration

- If you are completing this step for May, check the summary section is correct before you submit.

- Use the Print friendly function to capture your successful JobKeeper enrolment details in PDF format. You may want to save this information, including your JobKeeper receipt number, for your records.

Next step:

If you don’t have STP enabled payroll software and you have 40 employees or less

If you don’t have STP enabled payroll software and you have 40 employees or less, you need to:

- Have your eligible employees’ tax file number (TFN) and date of birth handy before you log in.

Log into ATO online services through myGov, or the Business Portal using myGovID.

View the COVID-19 screen and select Step 2 Identify and maintain employees eligible for JobKeeper wage subsidies.

Select the month you are identifying eligible employees to claim for. You could be identifying eligible employees for payments made in April or May 2020.

Confirm that you are nominating yourself as the eligible business participant. Select your eligible JobKeeper status. JobKeeper status identifies the JobKeeper fortnights (FN) that you’re claiming.

Select an eligible JobKeeper status:

- Not claiming yet – you are not currently eligible or not claiming for this month’s JobKeeper fortnights.

- Claim FN 1 and 2 – you are claiming both JobKeeper fortnights in this month.

- Claim only FN 1 – you are claiming fortnight one only. You are not eligible to claim fortnight two.

- Claim from FN 2 – you are claiming fortnight two only. You are not eligible to claim fortnight one.

If you do not want to claim the JobKeeper payment for yourself, or you are not currently eligible as a business participant, select Not claiming yet from the drop down menu.

Identify your eligible employees

Enter details of your eligible employees.

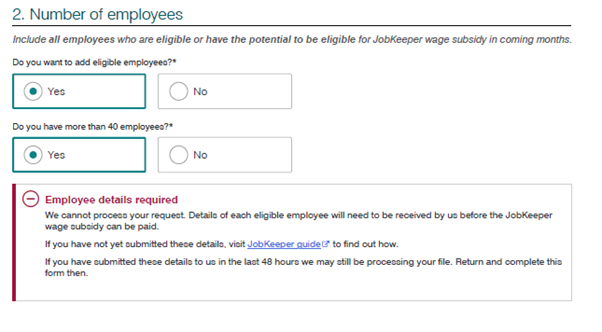

After you have logged in and confirmed your eligible business participant status, you will be asked about:

- adding eligible employees – select Yes if you want to add eligible employees

- if you have more than 40 employees – select No, to indicate you have 40 employees or less. This will allow you to add their details into the form.

If you have more than 40 employees, see 2. No STP enabled payroll software and you have more than 40 employees.

Add up to 40 eligible employees using their tax file number (TFN) and date of birth. Select Confirm then Save to add your eligible employee to the list.

Select a JobKeeper status for each of your eligible employees to identify the JobKeeper fortnights you’re claiming for them.

This list of identified eligible employees will appear as a prefilled list in future months and you will be able to make changes to it. You will not be able to add additional eligible employees once you complete Step 2.

Tips:

- If you are completing this step for April, you will move automatically to Step 3: Make a business monthly declaration

- If you are completing this step for May, check the summary section is correct before you submit.

- Use the Print friendly function to capture your successful JobKeeper enrolment details in PDF format. You may want to save this information, including your JobKeeper receipt number, for your records.

Next step:

If you don’t have STP enabled payroll software and you have more than 40 employees

We recommend that you start using Single Touch Payroll (STP) and JobKeeper enabled payroll software if you can. Look at the STP product registerExternal Link to find STP software.

If you don’t have STP enabled payroll software and you have more than 40 employees, you need to:

- Create your own JobKeeper report

- Log in to confirm your information

Create your own JobKeeper report

To create your own JobKeeper report:

- download the JobKeeper Payment guide (DOCX 290KB)This link will download a file sample payload files – Blank file (XLS 11KB)This link will download a file and Example file (XLS 11KB)This link will download a file – to produce your own JobKeeper report

- fill it in with the details of all your eligible employees

- provide it to us by uploading using the Business Portal File transfer function

Allow three days for the report to process.

Log into ATO online services through myGov, or the Business Portal using myGovID.

View the COVID-19 screen and select Step 2 Identify and maintain employees eligible for JobKeeper wage subsidies.

Select the month you are identifying eligible employees to claim for. You could be identifying eligible employees for payments made in April or May 2020.

Select an eligible JobKeeper status:

- Not claiming yet – you are not currently eligible or not claiming for this month’s JobKeeper fortnights.

- Claim FN1 and 2 – you are claiming both JobKeeper fortnights in this month.

- Claim only FN1 – you are claiming fortnight one only. You are not eligible to claim fortnight two.

- Claim from FN2 – you are claiming fortnight two only. You are not eligible to claim fortnight one.

If you do not want to claim the JobKeeper payment for yourself, or you are not currently eligible as a business participant, select Not claiming yet from the drop down menu.

Confirm your number of eligible employees:

- The number of eligible employees prefilled is based on the information you provided us in your lodged JobKeeper report.

- Check the number is correct or edit the number to reflect the correct number of eligible employees for each JobKeeper fortnight.

Tips:

- Future changes to eligible employees are actioned using JobKeeper reports via File transfer.

- If you are completing this step for April, you will move automatically to Step 3: Make a business monthly declaration

- If you are completing this step for May, check the summary section is correct before you submit.

- Use the Print friendly function to capture your successful JobKeeper enrolment details in PDF format. You may want to save this information, including your JobKeeper receipt number, for your records.

Next steps:

If you use STP enabled payroll software that does not offer JobKeeper functionality and you have more than 200 employees

If you use STP enabled payroll software that does not offer JobKeeper functionality and you have more than 200 employees, you need to:

Identify employees

First, do one of the following:

- manually create a JobKeeper allowance in your STP enabled payroll software and lodge a pay report with us via your software. Speak to your software provider to find out how to do this.

- ask us for a prefilled JobKeeper report. We will provide this using the Business Portal File transfer functionality. You will need to

- identify your eligible employees in this report and return the report to us using File transfer

- allow three days for the report to process before you log in.

- use the JobKeeper Payment Guide sample payload files– Blank file (XLS 11KB)This link will download a file and Example file (XLS 11KB)This link will download a file

- use the blank file to produce your own JobKeeper report and provide it to us by uploading it to the Business Portal File transfer function.

- allow three days for the report to process before you log in.

Log into ATO online services through myGov, or the Business Portal using myGovID.

View the COVID-19 screen and select Step 2 Identify and maintain employees eligible for JobKeeper wage subsidies.

Select the month you are identifying eligible employees to claim for. You could be identifying eligible employees for payments made in April or May 2020.

Confirm that you are nominating yourself as the eligible business participant. Select your eligible JobKeeper status. JobKeeper status identifies the JobKeeper fortnights (FN) that you’re claiming.

Select an eligible JobKeeper status:

- Not claiming yet – you are not currently eligible or not claiming for this month’s JobKeeper fortnights.

- Claim FN 1 and 2 – you are claiming both JobKeeper fortnights in this month.

- Claim only FN 1 – you are claiming fortnight one only. You are not eligible to claim fortnight two.

- Claim from FN 2 – you are claiming fortnight two only. You are not eligible to claim fortnight one.

If you do not want to claim the JobKeeper payment for yourself, or you are not currently eligible as a business participant, select Not claiming yet from the drop down menu.

Confirm your number of eligible employees:

The number of employees prefilled depends on the process you used to identify employees:

- the pay report you lodged with us via your software

- the prefilled JobKeeper report we provided and you returned to us

- the JobKeeper report you produced and returned to us.

Check the number of employees is correct or edit the number to reflect the correct number of eligible employees for each JobKeeper fortnight.

Tips:

- You can change eligible employees in your software or using JobKeeper reports through File transfer.

- If you are completing this step for April, you will move automatically to Step 3: Make a business monthly declaration

- If you are completing this step for May, check the summary section is correct before you submit.

- Use the Print-friendly function to capture your successful JobKeeper enrolment details in PDF format. You may want to save this information, including your JobKeeper receipt number, for your records.

Next steps:

If you have any concerns or queries about this process, please contact your LBW Representative to get assistance